By Belinda A. (Lynn) Burns, CPA, JD, CFP

As the end of the year grows nearer, many of our clients are considering our charitable contributions for 2025 and 2026. The 2025 Tax Act (also known as the One Big Beautiful Bill) made several changes that could affect the tax benefits of our charitable gifts. Among these changes include:

- increasing the limit on state and local income taxes, real and personal property taxes and state and local general sales taxes (SALT) which will allow more individuals to itemize deductions;

- adding a new .5% floor on itemized charitable deductions after 2025; and

- reinstating limited charitable deductions after 2025 for individuals who do not itemize deductions. An individual who doesn't itemize deductions for 2026 can deduct up to $1,000 of cash contributions to public charities. A couple that doesn’t itemize can deduct up to $2,000.

The 60% of adjusted gross income (AGI) limitation on cash distributions to public charities has become permanent. The 30% AGI limitation on noncash gifts to public charities also remains unchanged. Qualified charitable deductions from IRAs, which are limited to $108,000 in 2025 and $115,000 in 2026, are not subject to the percentage limitations.

It is likely more taxpayers will be able to itemize deductions in 2025 because the 2025 Tax Act increased the limitation for the SALT deduction from $10,000 for 2024 to up to $40,000 for 2025 through 2029. The amount will be increased by 1% each year beginning in 2026. The new limitation begins to phase out by 30% to the extent the taxpayer’s AGI exceeds $500,000.

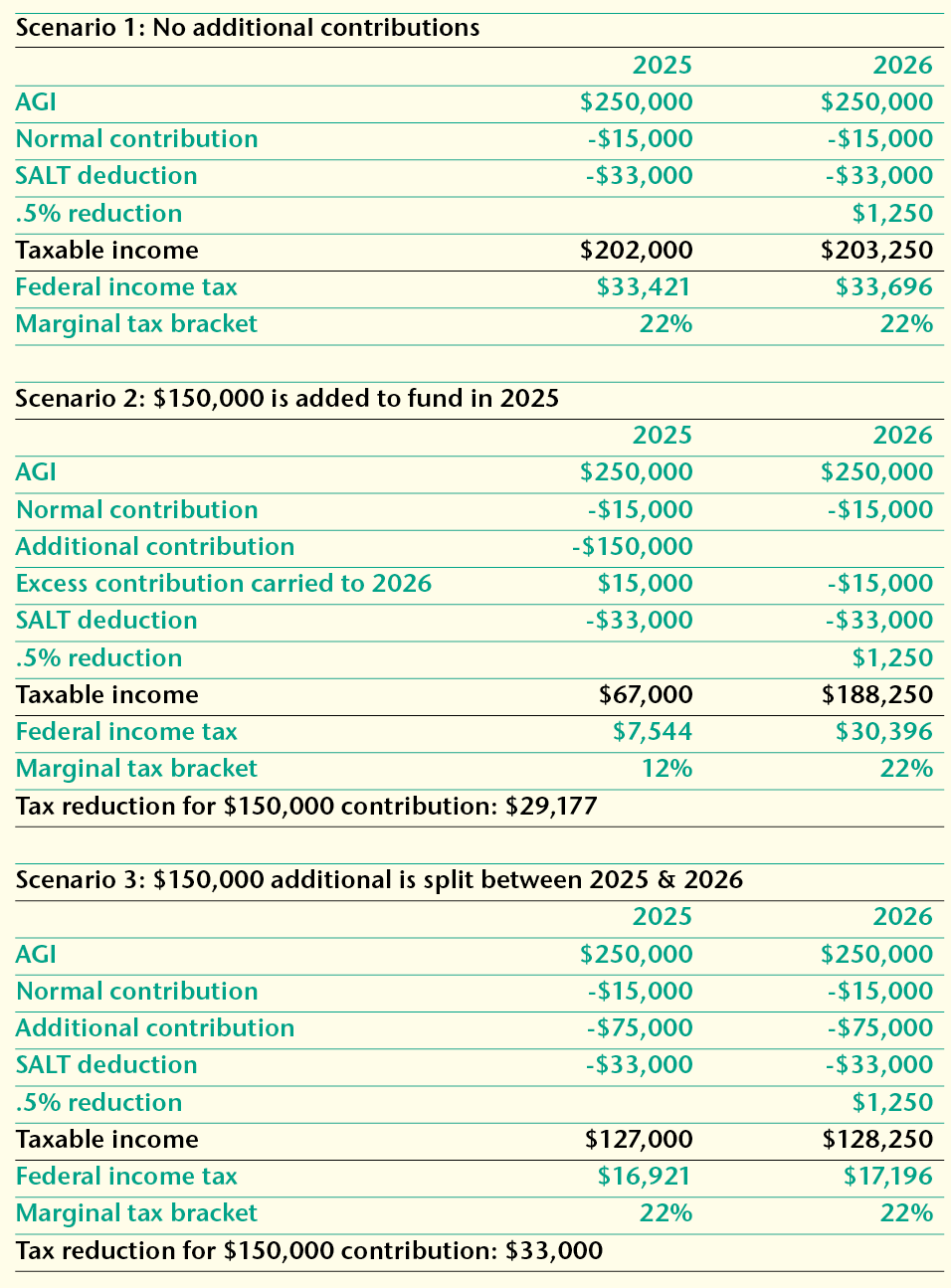

One way that that you can help your clients maximize these tax benefits is by working with The Dayton Foundation. For example, let’s say Bill and Barbara Taxpayer want to create a field of interest fund at The Dayton Foundation and initially fund it with $150,000. Their 2025 AGI will be $250,000. Their state and local income taxes and real estate taxes total $33,000. They normally make charitable contributions of $15,000 per year. Their standard deduction is $31,500 for 2025 and $32.200 for 2026. Each of them is 60 years old. Both have significant IRAs.

Bill and Barbara had no tax benefit from their 2024 contributions of $15,000 because their limited SALT deduction of $10,000 plus their contributions totaled $25,000 which did not exceed their 2024 standard deduction of $29,200. Because they can fully deduct their state and local income taxes and real estate taxes in 2025, they will receive a tax benefit from their contributions.

If Bill and Barbara wish to use cash to open their fund in 2025, they could deduct up to $150,000 (60% of their AGI). Their normal charitable contributions, plus the amount they wish to give to their new fund, exceed this amount. The excess would be carried over for deduction for up to 5 years.

They could use appreciated securities to fund their contribution, but only $75,000 of appreciated securities would be deductible in either 2025 or 2026. They could donate some cash and some securities. Any excess contributions could be carried forward for up to 5 years.

The $150,000 donation would reduce their 2025 marginal tax bracket to 12%. They may wish to split their contribution between 2025 and 2026 to reduce the amount of 2026 taxable income subject to the 22% marginal tax bracket. Splitting the gift between the two years would increase the tax benefit by $4,000.

Keep in mind the 2025 Tax Act did add a floor on itemized charitable deductions. Total charitable contributions must exceed .5% of AGI to be deductible after 2025. For Bill and Barbara, who have AGI of 250,000, .5% of that AGI is $1,250. Therefore, Bill and Barbara’ s deduction will be reduced by $1,250 if it was made in 2026.

Beginning in 2026, individuals whose taxable income is large enough to be subject to the 37% marginal tax bracket will be subject to a phase out of their itemized deduction. For a married couple, the 37% marginal tax bracket starts at $768,700. For a single individual, the 37% marginal tax bracket starts at $640,600. The reduction is 5.4% of the lesser of:

- itemized deductions reduced by the SALT phaseout and the .5% contribution floor; or

- the taxable income plus the itemized deductions reduced by the SALT and the .5% floor minus the number where the 37% marginal tax bracket begins.

If a married couple had $900,000 of taxable income and $200,000 of adjusted itemized deductions, the reduction would be $10,800 (lesser of $200,000 x 5.4%=$10,800 or $900,000 + $200,000 -$768,700 x 5.4% = $17,890).

Timing charitable gifts in the year most beneficial to your clients is key to helping them navigate these new tax changes and maximize their tax benefits. The Dayton Foundation offers a wide array of giving vehicles that can help you help your clients make the most of their charitable dollars.

Belinda A. (Lynn) Burns, CPA, JD, CFP, is the owner of Burns Tax Consulting, LLC. She has more than 35 years of experience advising individuals and closely held businesses on tax matters. Prior to opening her own business, Lynn was a member of the private client advisor team with Deloitte. She is a longtime member of The Dayton Foundation’s Development Committee.

Please note: The Dayton Foundation does not practice law or offer financial or tax advice. The Foundation recommends that people considering establishing funds or legacies through the Foundation consult their financial, tax or legal advisor.